Both option trading backtest approaches rely on the fact that there has been a bullish momentum pattern in Alphabet stock 7 calendar days before earnings. Further, we use moving averages as a safety valve to try to avoid opening a bullish position while a stock is in a technical break down, like the fourth quarter of 2018.

WE RECOMMEND THE VIDEO: Trading sessions | Economic news | Binary options tutorial

Trading sessions | Economic news | Binary options tutorial Hi there! I'm Lady Trader and in this video I'll tell you about Trading sessions and Economic news!

Backtest 1: The Bullish Option Trade Before Earnings in Alphabet Inc

We start with the backtest that shows a higher historical return, but lower historical win rate.

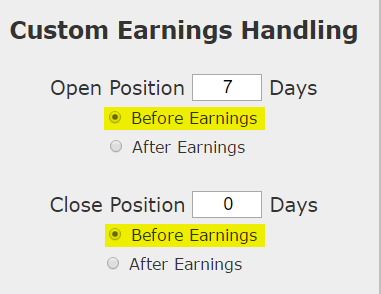

We will examine the outcome of getting long a weekly call option in Alphabet Inc 7-days before earnings (using calendar days) and selling the call before the earnings announcement if and only if the stock price is above the 50-day simple moving average.

Here's the set-up in great clarity; again, note that the trade closes before earnings since GOOGL reports earnings after the market closes, so this trade does not make a bet on the earnings result.

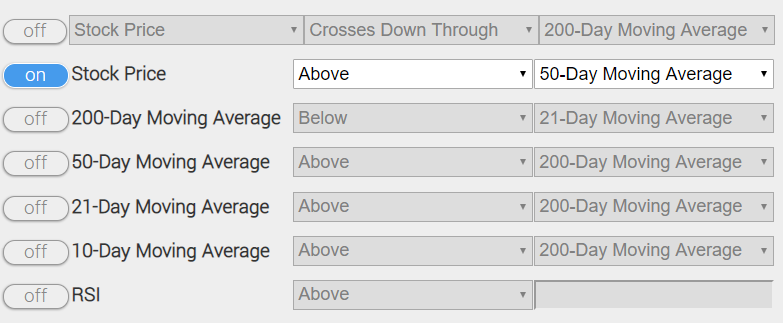

And here is the technical analysis -- note only one is "turned on," and that is the 50-day moving average requirement.:

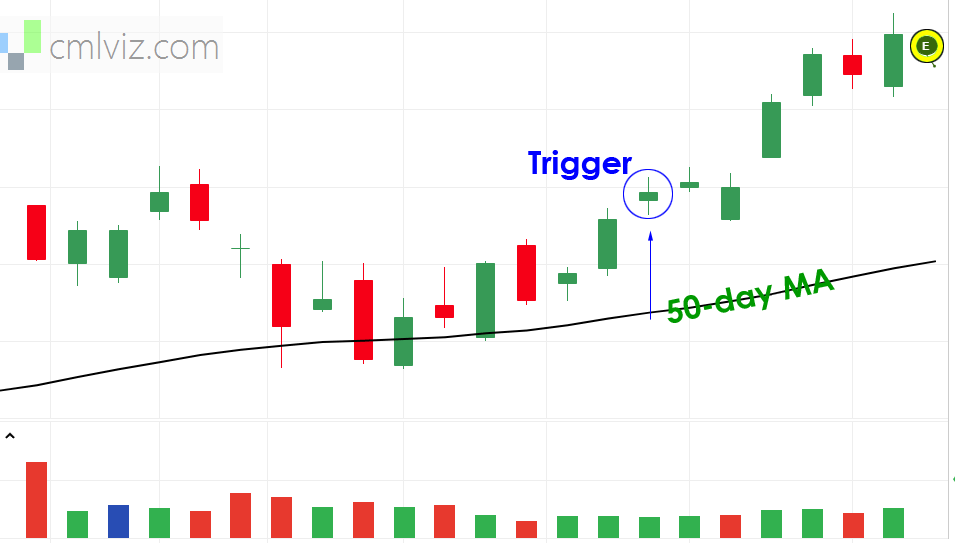

Here's a visual representation, where the stock price 7-days before earnings (circled) is above the 50-day moving average (black line), and therefore triggers a back-test.

If the stock price fails the technical requirement, it's fine, we just put a pin in it and check next quarter.

RISK MANAGEMENT

We can add another layer of risk management to the back-test by instituting and 40% stop loss and a 40% limit gain. Here is that setting:

In English, at the close of each trading day we check to see if the long option is either up or down 40% relative to the open price. If it was, the trade was closed.

RESULTS

Here are the results over the last three-years in Alphabet Inc:

| GOOGL: Long 40 Delta Call |

| % Wins: | 70% |

| Wins: 7 | Losses: 3 |

| % Return: | 277% |

The mechanics of the TradeMachine® stock option backtester are that it uses end of day prices for every back-test entry and exit (every trigger).

Notice that while this is a 3-year back-test and we would expect four times that many earnings triggers (4 earnings per year), the technical requirement using the 50-day moving average has avoided 2 pre-earnings attempts. In other words -- it's working.

Setting Expectations

While this strategy had an overall return of 277%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 27.6%.

Backtest 2: The "Not Bearish" Option Trade Before Earnings in Alphabet Inc

With a similar set-up, we examine the same phenomenon -- that is, pre-earnings bullish momentum. But, this time, rather than backtesting owning a call option with the earnings date occurring in the options expiration period, we look at the other side.

We examine selling a put spread in options that expire before earnings are announced. Specifically, we look at opening the trade 7 calendar days before earnings, selling a 40 delta / 10 delta put spread, in options that expire the closest to 5-days but before the earnings date. We don't us any stops or limits -- this backtest simply waits until expiration.

We also note that the technical requirements with the stock above the 50-day moving average, are identical -- this should result in the same number of trades.

This is a trade, unlike the long call, that takes a position on the stock that is simply "not bearish," as opposed to aggressively bullish.

RESULTS

Here are the results over the last three-years in Alphabet Inc for the short put spread -- again, since these options are selected to expire before the earnings dates, this backtest does not take earnings risk.

| GOOGL: Short 40 / 10 Delta put Spread |

| % Wins: | 100% |

| Wins: 10 | Losses: 0 |

| % Return: | 161% |

The mechanics of the TradeMachine® stock option backtester are that it uses end of day prices for every back-test entry and exit (every trigger).

Setting Expectations

While this strategy had an overall return of 161%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 20.5%.

Decision

So, there you have it in black and white. Owning the pre-earnings call yielded a substantially higher return, but with a 70% win rate, and the 3 losses, they were substantial, averaging -33.5%. returns (losses).

This is in contrast to the short put spread which has yielded considerably smaller returns, but no losses in the last 3-years.

Is This Just Because Of a Bull Market?

It's a fair question to ask if these returns are simply a reflection of a bull market rather than a successful strategy. It turns out that this phenomenon of pre-earnings optimism also worked very well during 2007-2008, when the S&P 500 collapsed into the "Great Recession."

The average return for this strategy, by stock, using the Nasdaq 100 and Dow 30 as the study group, saw a 45.3% return over those 2-years. And, of course, these are just 8 trades per stock, each lasting 7 days.

* Yes. We are empirical.

Back-testing More Time Periods in Alphabet Inc

Now we can look at just the last year as well. We start with the long call back-test in which the options include the earnings date within the expiration period.

| GOOGL: Long 40 Delta Call |

| % Wins: | 100.00% |

| Wins: 2 | Losses: 0 |

| % Return: | 115% |

And now we can look at the short put spread in which the options exclude the earnings date within the expiration period.

| GOOGL: Short 40 / 10 Delta Put Spread |

| % Wins: | 100.00% |

| Wins: 2 | Losses: 0 |

| % Return: | 42.3% |

Again, the contrast is clear, but the decision is personal and not obvious.

WHAT HAPPENED

Don't trade blind, please. Try pattern recognition.

Risk Disclosure

Past performance is not an indication of future results.

Ophir Gottlieb is the CEO & Co-founder of Capital Market Laboratories . Mr Gottlieb’s learning background stems from his graduate work in mathematics and measure theory at Stanford University and his time as an option market maker. He has been cited by Yahoo! Finance, CNNMoney, MarketWatch, Business Insider, Reuters, Bloomberg, Wall St. Journal, Dow Jones Newswire, Barron’s, Forbes, SF Chronicle, Chicago Tribune and Miami Herald. He created and authored what was believed to be the most heavily followed option trading blog in the world for three-years.

What Is SteadyOptions?

Full Trading Plan

Complete Portfolio Approach

Diversified Options Strategies

Exclusive Community Forum

Steady And Consistent Gains

High Quality Education

Risk Management, Portfolio Size

Performance based on real fills

Non-directional Options Strategies

10-15 trade Ideas Per Month

Targets 5-7% Monthly Net Return

Recent Articles

Articles

Pricing Models and Volatility Problems

Most traders are aware of the volatility-related problem with the best-known option pricing model, Black-Scholes. The assumption under this model is that volatility remains constant over the entire remaining life of the option.

By Michael C. Thomsett, August 16

- Added byMichael C. Thomsett

- August 16

Option Arbitrage Risks

Options traders dealing in arbitrage might not appreciate the forms of risk they face. The typical arbitrage position is found in synthetic long or short stock. In these positions, the combined options act exactly like the underlying. This creates the arbitrage.

By Michael C. Thomsett, August 7

- Added byMichael C. Thomsett

- August 7

Why Haven't You Started Investing Yet?

You are probably aware that investment opportunities are great for building wealth. Whether you opt for stocks and shares, precious metals, forex trading, or something else besides, you could afford yourself financial freedom. But if you haven't dipped your toes into the world of investing yet, we have to ask ourselves why.

By Kim, August 7

- Added byKim

- August 7

Historical Drawdowns for Global Equity Portfolios

Globally diversified equity portfolios typically hold thousands of stocks across dozens of countries. This degree of diversification minimizes the risk of a single company, country, or sector. Because of this diversification, investors should be cautious about confusing temporary declines with permanent loss of capital like with single stocks.

By Jesse, August 6

- Added byJesse

- August 6

Types of Volatility

Are most options traders aware of five different types of volatility? Probably not. Most only deal with two types, historical and implied. All five types (historical, implied, future, forecast and seasonal), deserve some explanation and study.

By Michael C. Thomsett, August 1

- Added byMichael C. Thomsett

- August 1

The Performance Gap Between Large Growth and Small Value Stocks

Academic research suggests there are differences in expected returns among stocks over the long-term. Small companies with low fundamental valuations (Small Cap Value) have higher expected returns than big companies with high valuations (Large Cap Growth).

By Jesse, July 21

- Added byJesse

- July 21

How New Traders Can Use Trade Psychology To Succeed

People have been trying to figure out just what makes humans tick for hundreds of years. In some respects, we’ve come a long way, in others, we’ve barely scratched the surface. Like it or not, many industries take advantage of this knowledge to influence our behaviour and buying patterns.

- Added byKim

- July 21

A Reliable Reversal Signal

Options traders struggle constantly with the quest for reliable reversal signals. Finding these lets you time your entry and exit expertly, if you only know how to interpret the signs and pay attention to the trendlines. One such signal is a combination of modified Bollinger Bands and a crossover signal.

By Michael C. Thomsett, July 20

- Added byMichael C. Thomsett

- July 20

Premium at Risk

Should options traders consider “premium at risk” when entering strategies? Most traders focus on calculated maximum profit or loss and breakeven price levels. But inefficiencies in option behavior, especially when close to expiration, make these basic calculations limited in value, and at times misleading.

By Michael C. Thomsett, July 13

- Added byMichael C. Thomsett

- July 13

Diversified Leveraged Anchor Performance

In our continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the theory that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics. Not only does overall performance tend to increase, but volatility and drawdowns tend to decrease: